Time:2024-03-22 Click:119

原作者:西游

原始来源:ChainCatcher

自 MEME 代币 BOME(Book of Meme)市值在 3 天内创下超过 20 亿美元的纪录以来,“在 Solana 发行 MEME 代币并向未知地址充值 SOL”已成为新趋势。 巨大的效益效应彻底改变了加密社区用户。 Fomo,在几个小时内从未知地址轻松筹集价值数百万甚至数千万美元的 SOL 已不再是新鲜事。

MEME币的财富效应为Solana带来了巨大的流量和关注度,吸引了众多国外应用加入Solana生态。

3月15日,NFT卡牌游戏Parallel宣布在Solana上线AI生存模拟游戏Colony; 3月17日,IDO平台DAO Maker宣布扩展到Solana网络,并计划上线4个Solana IDO项目; 3 月 18 日,DeFi 游戏化平台 DEGO Finance 将在 Solana 上线。

DeFiLlama数据显示,Solana链上24小时交易额约为23.9亿美元,捕获费用为39.4亿美元。 同期,以太坊链上交易额为28.6亿美元; 3月19日Solana链上DEX交易额为36.2亿美元,连续四天位居第一,近五天平均交易额超过30亿美元。 以太坊链上DEX日交易量为30.05亿美元,排名第二。

事实上,在 MEME 炒作热潮之前,Solana 链上的热点就从未停止过,从去年的 DePIN 热潮到 MEME 帽子狗 Bonk,以及生态预言机 Pyth Network、DEX 平台 Jupiter、跨链协议 Wormhole等项目空投一波又一波。 用社区用户的话说,Solana链上不乏机会。 是真正的“贫富链”。

除了MEME币之外,Solana链生态中还有哪些机会值得参与和关注? 本文将对Solana链上活跃的代表性项目进行梳理。

DEX 三巨头:Raydium、Orca、Jupiter

Raydium:MEME 代币交易的首选 DEX

Raydium 是一个建立在 Solana 链上的自动化做市商 AMM 交易平台。 工作机制与Uniswap类似。 该平台最初创建于2021年,因将流动性与SBF主导的订单簿式DEX Serum平台整合而被用户所熟知。 随着SBF的倒闭,Serum陷入了流动性危机,最终关闭并更换了官方Twitter账户。 但Raydium一直坚持产品迭代升级,并随着Solana生态的复苏再次成为顶级DEX。

Currently, Raydium product functions include DEX trading, AMM Swap exchange, liquidity mining, pledge mining, IDO launch Acceleraytor and other functions.

The recent boom in MEME hype on the Solana chain, and popular MEME token fund pools such as BOME and SLERF, are all created on the Raydium platform. More than 90% of token trading volume occurs on this platform, which is the current MEME token on the Solana chain. DEX with the largest currency trading volume.

On March 17, Lanchpad platform DAOMaker announced its expansion to the Solana network, and will add a $2 million SOL liquidity pool on Raydium and launch 4 Solana IDO projects. Among them, the first AI e-commerce project YOUR AI has launched the token YOURAI on Raydium on March 18.

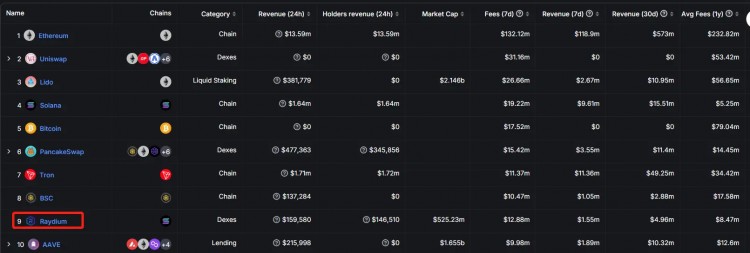

According to DeFiLlama data, in the past seven days, the transaction fees captured by the Raydium platform exceeded US$12.91 million, and the fees captured on the Solana chain during the same period were US$19.22 million. The platform's revenue ranks among the top ten in the DeFi market.

The platform token RAY has increased by 89% in the past 30 days, and is currently quoted at US$2.04, with a market value of US$530 million and FDV of US$1.13 billion.

Trading DEX leader Orca

Orca is also the first-generation AMM (automatic market maker) DEX on the Solana chain. Unlike DEXs that integrate many functions, the platform page is very simple and only supports token exchange and liquidity pool addition.

According to DeFiLlama, the trading volume of the Orca platform within 24 hours was US$1.415 billion, ranking third in the entire DEX market, second only to Uniswap and Pancakeswap, and is the DEX with the largest trading volume on the Solana chain.

On March 20, the platform token ORCA was quoted at US$4.03, with a market value of US$190 million and FDV of US$4.01 billion.

Deal aggregator Jupiter

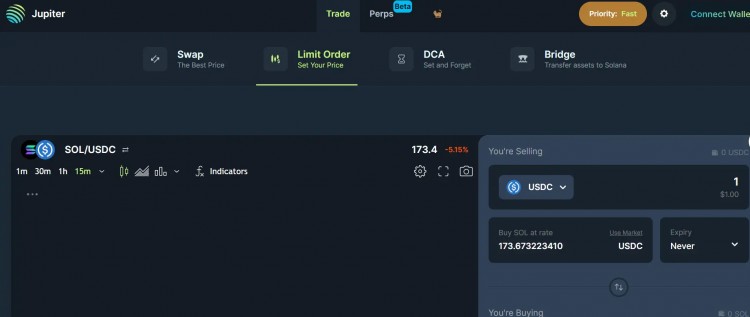

Jupiter is a transaction aggregator on the Solana chain, aiming to provide users with the best exchange rates and experience by integrating the main liquidity markets on the Solana chain.

In January this year, Jupiter announced that it would airdrop 1 billion JUP tokens to about 955,000 Solana wallet addresses. It was the project with the widest coverage of airdrop addresses to date, and it was once a hit.

At present, Jupiter has integrated multiple DEX paths on the Solana chain, including Orca, Raydium, Mercurial, etc. The platform not only supports SWAP, but also has functions such as limit orders and fixed investment.

In addition to spot trading, Jupiter will also launch a contract function, which is currently in the testing phase. Only three assets, SOL, ETH, and WBTC, are open.

In addition, Jupiter also launched LFG Launchpad, which aims to help emerging and existing cryptocurrency projects raise funds, distribute tokens, and quickly activate liquidity and launch more tokens in a decentralized and transparent manner.

On March 13, Jupiter announced that the first round of LFG Launchpad project voting had ended, and the first batch of launch projects selected were the cross-chain communication protocol Zeus Network and the NFT lending protocol SharkyFi. Among them, Zeus Network, LFG Launchpad’s first IDO project, will launch a public offering of tokens on April 4.

On March 21, Jupiter announced that JUP DAO will inject 10 million USDC and 100 million JUP next week to accelerate Jupiverse growth and public funding.

According to Coingecko data, on March 20, the platform token JUP was currently quoted at US$1.19, with an increase of more than 120% in the past 30 days, with a market value of US$1.6 billion and an FDV of US$11.8 billion.

Liquid staking track: Marinade, Jito, BlazeStake

腌料

Marinade is the largest liquidity staking protocol on the Solana chain. Users can pledge SOL on the platform and receive mSO as a pledge certificate. While obtaining PoS network pledge income, they can also participate in DeFi interactions on other chains and improve fund utilization.

According to the official website, the number of SOL pledged by Marinade exceeds 9.98 million, and the value of locked assets is US$1.74 billion. TVL ranks first on the Solana chain, with an annualized return rate of 8.9%.

The governance token MNDE was launched in 2021 with a total supply of 1 billion. According to CoinGecko, the trading price of the MNDE token is approximately US$0.31, with a circulating market value of US$79.95 million and an FDV of US$310 million.

MEV Liquidity Staking Protocol Jito

Jito is the second largest liquid staking protocol on the Solana chain. Users can stake SOL in exchange for the staking certificate LSD token JitoSOL. The platform not only provides users with staking rewards on the PoS network, but also distributes the MEV income rewards obtained to staking users.

According to the official website, on March 18, the number of SOL pledged on the Jito platform was approximately 9 million, worth US$1.6 billion, making it the second largest application of TVL on the Solana chain.

In November last year, Jito launched the governance token JTO, which is currently quoted at US$3.05, with a circulating market value of US$357 million and an FDV of US$3.05 billion.

火焰股份

BlazeStake is the third largest liquid staking protocol on the Solana chain. Users pledge SOL to obtain the pledge token bSOL.

DeFiLlama shows that on March 20, the asset value (TVL) locked on the BlazeStake platform was approximately US$470 million, the governance token BLZE was quoted at US$0.0018, and the total issuance amount was 10 billion.

Oracle Pyth Network

Pyth Network is a decentralized oracle project on the Solana chain. It can transfer real-world data to the on-chain world, complete data interoperability between the blockchain and the real world, and support the construction of the next generation of DeFi. It was created by members of the Jump Trading team. , is a star project within the Solana ecosystem.

In October last year, Pyth Network announced the economic model of the token PYTH, issued a total of 10 billion tokens, and airdropped 600 million tokens to 750 million wallets, causing a commotion in the encryption market.

On March 20, PYTH was quoted at $1.02 and FDV was $10.1 billion.

Cross-chain facility Wormhole

Wormhole was originally a cross-chain bridge incubated and supported by Jump Crypto, focusing on asset interoperability between Ethereum and Solana. With the development of the project, it has evolved into a universal messaging protocol supporting multiple chains and completed with Jump Crypto spin off.

On March 7, the cross-chain protocol Wormhole announced the token W economic model, with a total supply of 10 billion coins and an initial circulation of 1.8 billion coins, which will be distributed on 5 initial chains in the form of ERC20 and SPL, namely Ethereum , Solana, Arbitrum, Optimism and Base, and will airdrop 610 million W tokens to more than 397,000 eligible addresses.

As of press time, W tokens have not been officially opened for trading, and the over-the-counter Whales Market price is $1.78.

Derivatives trading platform Drift Protocol

Drift Protocol is a DeFi derivatives trading platform built on Solana, providing multiple types of derivatives markets, including perpetual contracts, spot and spot margins, lending, etc. It was founded in 2022.

According to the official website, the value of locked crypto assets (TVL) on March 20 was US$286 million, and the open interest volume reached US$150 million. The trading volume last week exceeded US$2.2 billion, setting a record high, and a total of The transaction volume exceeds $15.9 billion and the number of users is 159,000.

Currently, Drift has not issued coins. In January this year, it launched a reward points program, and users can earn points by participating in transactions on the platform.

Lending agreement: Kamino, Marginfi

Chimney

Kamino is a lending protocol on the Solana chain and integrates lending, automated income strategies, and leverage functions to provide users with a unified and secure DeFi product suite.

On Kamino, users can borrow assets, provide leveraged liquidity to DEX, build automated yield strategies, and use centralized liquidity positions as collateral, etc.

In January this year, Kamino launched a points incentive plan, and users can earn points by using products, such as depositing, borrowing, providing liquidity, etc.

According to official information, this point incentive will last for about three months. At the end of the first quarter or the beginning of the second quarter, the platform token KMNO Genesis airdrop will be launched.

DeFiLlama shows that the value of assets locked on the Kamino platform has exceeded US$1.18 billion, and TVL is the third largest protocol in the Solana ecosystem.

边际

Marginfi is also a decentralized lending protocol on Solana, and integrates Swap, LST, cross-chain bridges, stable coins, etc. The protocol provides users with a unified account to manage their assets, or form an investment portfolio and improve the foundation Capital efficiency of transaction agreements.

In February, Marginfi launched YBX, an interest-bearing stablecoin based on LST assets, which supports the use of Solana ecological LST assets (such as JitoSOL, mSOL) as collateral assets for casting. Users can also participate in the Solana network pledge block income and MEV tips while capturing Get more potential revenue.

At present, Marginfi has not yet issued coins, but has launched an incentive points plan. Users also earn points through pledge borrowing. The current value of assets locked on the platform is US$777 million, and TVL ranks fourth in the Solana ecosystem.