Time:2024-03-07 Click:105

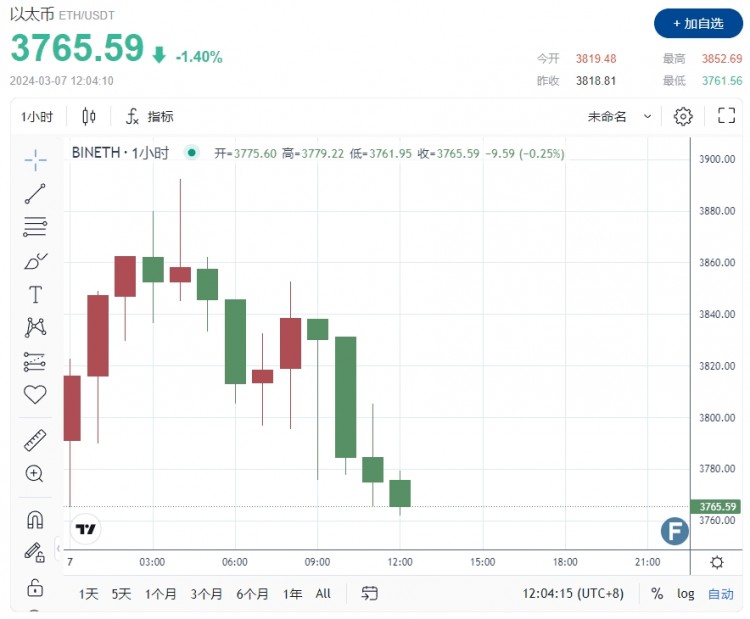

On Thursday (March 7), Bitcoin failed to rebound at US$69,000. After Ethereum hit a two-year high of US$3,900, it plummeted back to US$3,765. This was mainly due to the US Securities Regulatory Commission and the Commodity Futures Trading Commission (CFTC). Concerned with rule conflicts. The CFTC has warned that Prometheum, an SEC-registered broker-dealer, could force the agency to decide whether ether is a security.

U.S. CFTC Chairman Rostin Behnam testified at a House Agriculture Committee hearing on Thursday, saying: “Bitcoin and Ethereum are both commodities.”

He talked about the decision in February by the U.S. Securities and Exchange Commission’s special purpose broker-dealer (SPBD) to authorize Prometheum to provide ether custody services. "It's my understanding, primarily from reading the news and talking to my staff, that they have contacted the SEC and this was Prometheum's independent decision."

He emphasized: "As far as I understand, this is not a decision of the SEC at all, but a personal decision of Prometheum."

Behnam testified that he did not believe the decision was consistent with the SEC’s view of ether, adding that how the SEC responds to Prometheum’s decision is “obviously very critical.”

“The question is, if the SEC does take any action to fundamentally validate Prometheum’s decision to treat ether as a security, then ether will be subject to SEC rules, not CFTC rules,” he Continued name.

The SEC-registered SPBD can only custody securities, but SEC Chairman Gary Gensler did not make it clear whether ether is a security or a commodity.

Behnam emphasized the need to maintain market integrity and believed that the conclusion that "Ethereum is a commodity" was a multi-year decision and that the market was functioning well.

He noted in earlier prepared remarks that the CFTC would "regularly push beyond the limits of existing law" due to market developments and technology.

He noted that increased participation in the cryptocurrency market “tests the limits of existing regulatory frameworks.”

“The lack of legislation to address regulatory gaps in spot markets for digital commodity assets has not hindered public enthusiasm for digital assets,” he said. "I continue to believe Congress must act."

On the news, Ethereum retreated from a high of $3,900, falling to $3,765.

In terms of Bitcoin spot ETFs, according to data from Farside Investors, Bitcoin spot ETF inflows reached US$648 million on March 5. In terms of total inflows, the Bitcoin spot ETF has accumulated $8.617 billion in inflows.

Bitcoin Technical Analysis: A possible retest of 69,000

FXStreet’s Lockridge Okoth said that as optimism in the cryptocurrency market continues to rise, Bitcoin prices may return to the $69,000 mark.

He quoted analyst Coinmamba as saying: "The possibility of Bitcoin breaking through $69,000 twice is very low. If it is retested next time, we may see Bitcoin break this blockade."

"A likely move would be a break above the all-time high of $69,325 set on March 5, with the possibility of hitting the psychological level of $70,000. Such a move would represent an increase of approximately 5% from current levels."

Okoth mentioned that a closer look at the Bitcoin Relative Strength Index (RSI) shows that buying momentum is rising after the indicator rebounded near the 70 mark. If this trajectory continues, the RSI may soon break above the yellow band of the signal line. This crossover will revive the uptrend as it is interpreted as a buy signal.

However, on the other hand, if traders start cashing in gains, Bitcoin price could drop to retest the $65,000 threshold. In the worst-case scenario, Bitcoin could plummet to the psychological level of $60,000, before it could rise again.