Time:2024-02-05 Click:157

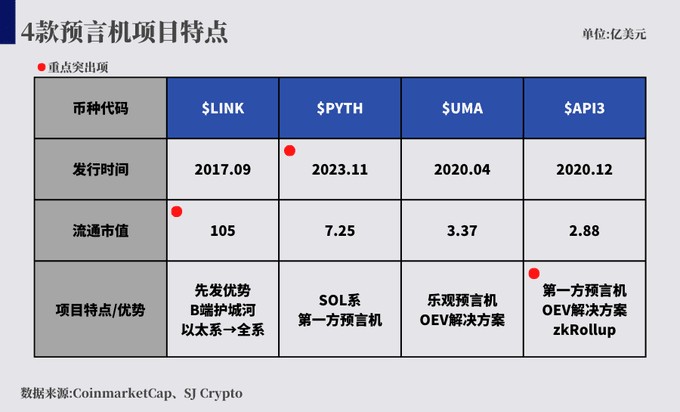

This article will briefly talk about the respective advantages of the four recently popular oracle machines, hoping to let you understand them in as simple a language as possible: LINK, PYTH, UMA, API3 and their characteristics

Outline of this article:

1. LINK is hard to beat

2. First-party oracle solution (PYTH&API3)

3.OEV solution (UMA&API3)

4. What is the recent focus of API3 on OEV? Can't~

The recent market attention of oracle machines is inseparable from the proposal and implementation of OEV solutions, so this article will also focus on this concept.

1. Why LINK is difficult to surpass

Whether it is from the perspective of first-mover advantage or the B-side moat that ChainLINK has built over a long period of time, it is destined to have an extremely solid industry ecological niche.

Many people may not understand what it means for LINK to be surpassed

It can almost be said that the DeFi track and even the data-heavy tracks in the industry will have to be migrated and reconstructed on the data side, or the ecosystem will more than double its current capacity. This is difficult to imagine in the short term.

(Sifting out some tedious differences in details, each of the four projects that have recently attracted market attention on the oracle track has its own characteristics)

It can be seen from the above table that the market value of LINK is not at the same level as that of the latecomers. Even the current market value of LINK accounts for about 64% of the entire track, and the actual product call market share is compared with other projects of the same type. to be higher

In addition, LINK has been iterating in various aspects in recent years, including the development of cross-chain ecological price feeding (already implemented)

At this point, I feel that there is no need to expand further on LINK~

2. First-party oracle solution (PYTH&API3 @API3DAO)

Let’s talk about PYTH first: a popular solution for the SOL system. This is why it is very vertically benchmarked against LINK. Behind it is the competition between the Ethereum system ecology and the SOL system ecology.

Let’s talk about the features it shares with API3: first-party oracles

That is to say, they operate their own oracle nodes that provide data. There is no doubt that the data provided by the data source is better than third-party data aggregation in terms of integrity, latency and quality.

But I think there is no obvious overwhelming advantage between the two. The B-side that provides data to the chain off-chain is trustworthy enough and has a well-designed penalty mechanism, which can make up for it to a large extent.

=And in terms of data diversity, the first party may not be as good as the third party's aggregation (of course the quality will also decrease year-on-year)

3.OEV solution (UMA&API3)

This is also the focus of this article. Let’s first talk about what OEV is: OEV For dApps that rely on oracles, any update or error in the data source may create opportunities for OEV. Anyway, it is related to the word [arbitrage]

A simple understanding is: the profit gained by a third party by exploiting the data error/lag status of the oracle machine.

The corresponding solution of OEV is the hot focus of the oracle track recently. UMA and API3 both have OEV solutions, and it can be said that the logic of the two is very similar, but the way of capturing is different.

But in the final analysis, they are feeding the "wrong profits" of the original third party back to the relevant stakeholders.

The advantage of API3 compared to UMA is that it uses ZK-Rollup, which can further capture OEV in a wider range and further reduce costs.

(UMA would like to mention in addition: the design of its optimistic oracle (OO) is also a highlight of the project, but this section mainly discusses OEV and will not expand further)

4. What is the recent focus of API3 on OEV? Can't~

In addition to the various solutions mentioned above, there are also some things that are controversial or based on my personal subjectivity:

Many researchers have focused this API3 on OEV, but if we talk about this alone, I don’t think it has any significant advantages over other oracle networks.

=(PYTH also has a first-party oracle, and UMA also has an OEV solution)

I think zk Rollup is the basis for it to have a certain degree of differentiation in the field of oracle machines. Everyone is aware of the involution of L2, and it has now reached the point where concepts are nested and superimposed.

=(There may be a bit of ambiguity here, I mean, how to create an OEV solution is important, not that solving OEV is not important)

Is zk rollup strange? It is not unusual in the current market, but the paradigm of the oracle OEV+zk Rollup is different.

Let’s not talk about whether it is necessary or not, but in terms of valuation logic, it is a step up from a single middleware (infrastructure valuation middleware)

It seems that when doing business in Web3 now, not doing L2 is a kind of "political incorrectness". At the moment, ETH has a sense of "hegemony" in the currency circle.

It does not actively coerce anyone, but everyone is passively coerced by it

I am a person who likes to talk about industry narratives. I even don’t understand why some people in the market criticize my thinking.

But Web3 does not produce actual value most of the time. Telling the story well can already attract short- and medium-term capital flows in the market.

Therefore, chasing stories and betting on emerging stories is a thing that has a high probability of being correct. Even if its business model may not conform to normal business logic in the long run, who can guarantee that we will participate in things and hold Can the token live for more than five years?

Brother, have you really come to the currency circle to do value investing at the bottom of five years?