Time:2023-12-06 Click:95

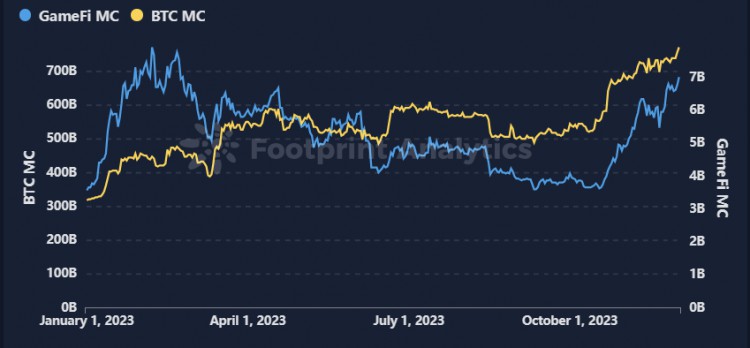

Against the backdrop of BTC's ascent from $ 25, 000 to $ 40, 000, the GameFi sector experienced a notable surge, propelled by the introduction and anticipated launches of several projects.

During the last bull market, notable Play-to-Earn (P2E) games such as Axie, Farmer World, and StepN emerged. Strictly speaking, these games did not offer an exceptional user experience; rather, their surge was predominantly driven by conceptual enthusiasm. However, following the recent bear market, many game projects initiated during that period have undergone substantial, long-term development. This also implies that 2024 will witness the launch of a plethora of high-quality Web3 games.

Besides, recent data suggests a resurgence of interest and growth within the gaming sector. Our analysis leads us to forecast that this positive momentum is poised to endure throughout the upcoming bull market.

Throughout the year 2023, the market capitalization of GameFi tokens demonstrated a strong correlation with Bitcoin. Notably, during periods of fluctuation in Bitcoin's market capitalization, GameFi tokens displayed amplified volatility. This implies that GameFi projects inherently carry higher risks and are more susceptible to fluctuations in funding, especially during periods of market downturn.

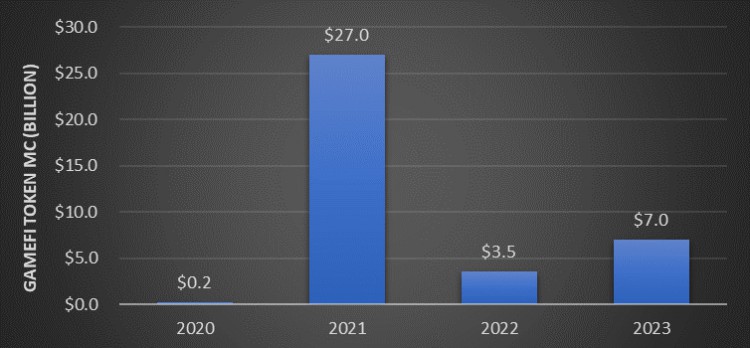

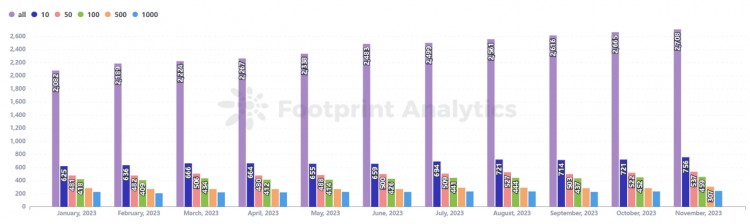

Currently, the Web3 gaming landscape is vibrant, with approximately 2, 700 active game projects and a market cap of $ 7 billion as of Dec 3 rd. However, despite the substantial market cap, the challenges of user acquisition and retention persist. It’s important to note that games with more than 1, 000 monthly active users are still a relatively small percentage, hovering around 9% of the total number of games, highlighting the difficulties faced by Web3 game developers in attracting and retaining users.

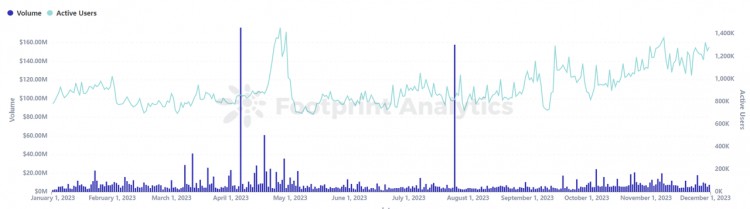

Throughout the first ten months of 2023, on-chain analysis reveals that the daily active users of Web3 games consistently hovered around 1 million. Subsequently, the number of active users exhibited a growth trend and remained high for Q4.

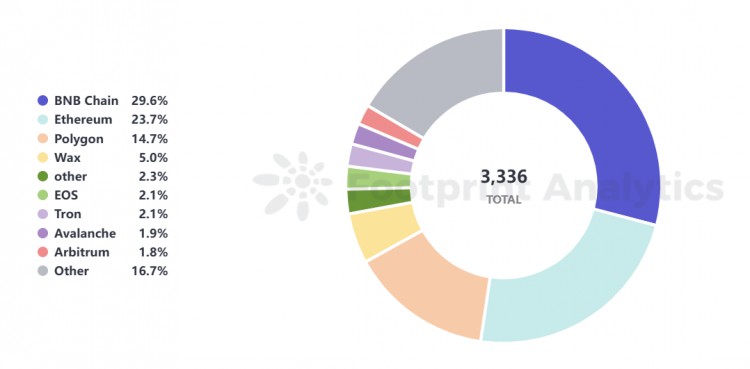

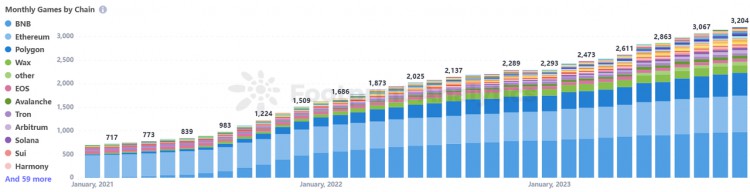

As of December 3 rd, 2023, the distribution of games across various blockchains exhibits stability, with BNB Chain leading at 29.6% , closely followed by Ethereum at 23.7% , and Polygon at 14.7% . However, a significant disparity is evident between these top three chains and second-tier blockchains such as Wax and EOS, which hold distributions of 5.0% and 2.1% , respectively.

Since 2022, the distribution pattern of games across diverse blockchains has demonstrated a consistent trend. With the flourishing Web3 gaming market, there is an expectation that additional chains will emerge, potentially posing challenges to the dominance of the top three chains.

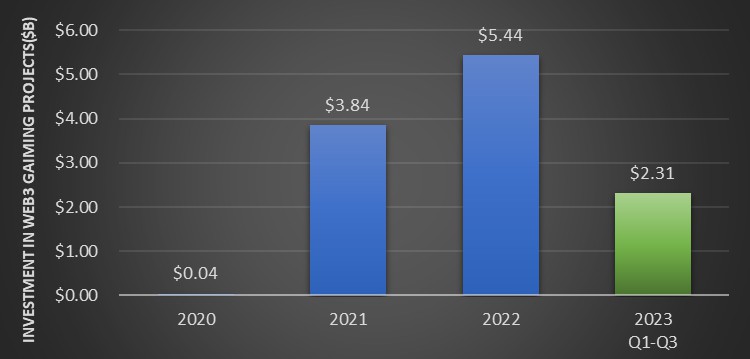

Note: 2020-2022:Footprint(Web3 gaming niche alone);2023 Q1-Q3:Dappradar(Game/Metaverse)

Furthermore, positive developments for GameFi were concentrated in November, with notable announcements from projects like Pixels, Illuvium, and Gala Games, among others. Additionally, the entry of traditional gaming giants like Ubisoft has elevated user expectations for the playability of blockchain games. With enhancing gaming experiences, and reduced user entry barriers, the future is poised to attract more capital and users into space.

On a note, we often reiterate that the investments executed in the previous year are poised to yield returns in the current year and potentially extend into the subsequent one. Notably, during Q4 2023, we were privileged to witness previews and beta versions of highly anticipated Web3 games. Consequently, a strategic decision was made to inaugurate the Coresky GameFi Season, thereby enhancing enthusiasm and unlocking the sector's inherent potential.

As the crypto market environment improved and sector rotation dynamics shaped the current bullish trend, GameFi witnessed a renewed surge of interest. Notably, established entities introduced new games (GasHero), veteran blockchain gaming platforms (Ronin), and emerging game titles (Bigtime), all gaining prominence in this revived wave of enthusiasm.

In terms of project cycles, Web3 games that secured funding during the previous GameFi Summer are now reaching the final stages of game production, with funding consumption nearing completion. Combined with the overall improvement in the macroeconomic landscape, it is inevitable that a substantial number of high-quality games will be launched on the market over the next year.

Although GameFi has encountered new opportunities, it still faces many challenges, such as user experience, token economy, and security supervision. And observing the GameFi sector, there is no single game that has managed to navigate through both bull and bear markets, ensuring long-term and stable operations. Therefore, effective investment strategies are still necessary.

About Coresky

Coresky is an Asset-packaged NFT launchpad and trading platform. The Coresky Launchpad converts primary market currency rights into Asset-packaged NFTs. Coresky leverages Launchpad's economic utility to drive user transactions while also addressing both primary and secondary market liquidity for crypto rights and the NFT trading market.

Learn More About Coresky:

Website:https://www.coresky.com/

Twitter:https://twitter.com/Coreskyofficial

TG Official:https://t.me/Coreskyofficial

TG Channel:https://t.me/CoreskyLaunchpadChannel

Discord:https://discord.gg/coresky

Medium:https://medium.com/@CoreskyLaunchpad