在不断变化的加密货币世界中,比特币最近的价格走势描绘了一幅复杂的图景,周一交易价格为 41,079 美元,下跌 2.01%。在这种波动中,业内知名人士发表了不同的看法。 VanEck 的首席执行官坚信比特币将保持其作为首要数字价值储存手段的地位。在更未来的预测中,Cathie Wood 推测比特币将出现天文数字般的增长,预计到 2030 年将增长 3,356%。

与此同时,加密领域的另一个主要参与者 Ripple 提出了对 2024 年的预测,为多方面的加密叙述增添了另一层内容。

VanEck 的立场:比特币是首要价值存储

投资管理公司 VanEck 的首席执行官 Jan van Eck 表达了他对比特币(BTC)坚定不移的信心,并表示他认为没有其他加密货币能够超越比特币,成为互联网上首要的数字商店。作为管理着 764 亿美元资产的公司的负责人,范·埃克驳斥了比特币泡沫的概念。

相反,他指出加密货币的持续表现优于其他投资策略。他预测,在持续增长的推动下,未来 12 个月内,比特币将创下历史新高。

Vaneck 首席执行官表示:#比特币是黄金的补充。 $BTC 拥有 5000 万用户的网络效应,因此不会出现“翻转”。

那些说比特币被犯罪分子利用的人,如果你是银行或与银行有关联的人,请不要扔第一块石头

他总结了...... pic.twitter.com/YooKq5KPbq

- 赛斯 (@seth_fin) 2023 年 12 月 17 日

Van Eck 还预计,专门从事现货比特币的交易所交易基金 (ETF) 的所有申请都会同时获得批准,包括他的公司在美国的投标。 市场分析师表示,美国证券交易委员会关于这些现货比特币 ETF 的决定,涉及主要参与者,例如贝莱德和灰度可能会通过明确的监管提振投资者信心,从而对比特币的价格产生积极影响。

Cathie Wood 对 2030 年比特币的大胆预测

Ark Invest 首席执行官、著名投资者 Cathie Wood 做出了一个大胆的预测,预计到 2030 年,比特币 (BTC) 的价值将达到 148 万美元。根据 Wood 的看涨前景,1,000 美元的投资可能会产生 34,557 美元的回报,这标志着较当前价值增长了惊人的 33,557%。

#ARKInvest 的 #CathieWood 刚刚重申了她的预测,即 #Bitcoin (#BTC) 有达到 100 万的趋势。

这次她的数字预计到 2030 年每 BTC 为 148 万美元。@giancarloperlas https://t.co/ISjMFmMSp5

— Blockzeit (@BlockzeitE) 2023 年 12 月 18 日

While skeptics point out challenges in adoption and inherent volatility, Wood underscores factors such as institutional adoption, inflation hedging capabilities, and Bitcoin’s utility in remittances as key drivers of its value. It’s noteworthy that Bitcoin has historically functioned more as a speculative asset than a common currency.

This perspective adds to the ongoing discourse on the future of cryptocurrencies, potentially influencing investor sentiment and contributing to a rise in Bitcoin’s price.

Ripple’s 2024 Crypto Market Outlook; Impact on BTC

Stuart Alderoty, Chief Legal Officer at Ripple, has disclosed their cryptocurrency market forecasts for 2024, focusing on the regulatory landscape. Alderoty anticipates that the U.S. Securities and Exchange Commission (SEC) will maintain its vigilant oversight of the industry.

While he predicts an outcome for the SEC’s ongoing lawsuit against Ripple, he also foresees continued regulatory actions against major players in the sector. He envisions judges serving as a crucial barrier against the SEC’s overreach, potentially setting the stage for future Supreme Court interventions.

Another key aspect of Alderoty’s prediction involves a division among US Congress members over the ideal approach to cryptocurrency regulation, which may place US crypto firms at a competitive disadvantage internationally. Ripple’s predictions highlight persistent regulatory challenges, which could significantly influence the broader cryptocurrency market sentiment, including Bitcoin (BTC).

Bitcoin Price Prediction

Bitcoin, a leader in the digital currency market, is currently valued at $42,375, experiencing substantial trading activity with a 24-hour volume of $17.26 billion. The 4-hour chart analysis shows Bitcoin’s pivot point at $41,735, aligning with the 38.2% Fibonacci retracement. Resistance levels are noted at $42,885, with subsequent higher resistances at $44,738 and $46,020. On the support side, the immediate level is $40,700 (38.2% Fibonacci), followed by $39,775 (50% Fibonacci) and $38,350 (61.8% Fibonacci).

The Relative Strength Index (RSI), at 43, reflects a neutral market stance, neither indicating overbought nor oversold conditions, yet it slightly inclines towards a bearish outlook. The 50-Day Exponential Moving Average (EMA), currently at $42,300, is in close proximity to Bitcoin’s price, suggesting the possibility of a short-term bullish movement.

The chart’s upward trendline provides support to Bitcoin around $41,735. Should candlesticks close below this trendline or pivot area, it may lead to a downward trend, potentially reaching the 50% or 61.8% Fibonacci retracement levels.

To summarize, Bitcoin’s trend seems to be bullish above the $41,735 mark. In the near future, it’s anticipated that Bitcoin will challenge its resistance levels, especially if it remains above the pivot point and the 50 EMA.

尽管如此,建议投资者密切关注低于这些关键水平的任何下行走势,因为此类变化可能预示着整体市场情绪的转变。

BOMEmillionairesaremakingalotofmoneyandtheirpocketsarebulging!#BOME#热门话题Thecurrentbullmarketissimplydominatedb...

用户将能够将其BNB和FDUSD放入单独的池中,在四天内种植OMNI代币,种植从2024年4月13日00:00(UTC)开始。OMNI农业积累日期(每天00:00:00-23:59:59UTC)每日总奖励(OMNI)BN...

现在直播:社区与我们的首席执行官兼联合创始人@jp_mullin888联系!在这里加入对话:https://tco/92UDB2UmQq收听与John的精彩而富有洞察力的会议,他将重点介绍MANTRA的最新发展、孵化器...

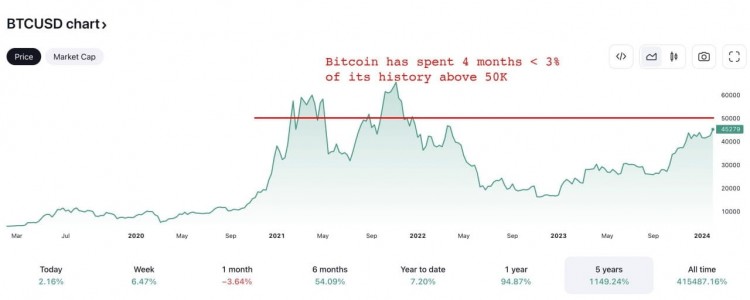

Fundstrat的TomLee的FOMO模型早在2019年,当比特币价值10,000美元时,Lee就表示,市场上FOMO的主要浪潮发生在比特币交易价格高于某一价格的3%的日子里。我们都知道那些日子接下来发生的事情:事实...