Coinbase has a practice of releasing research reports on assets before they go live for trading.

So far, Coinbase has published research on 58 assets, with 19 of them already listed for trading.

On average, it takes about 75 days for an asset to go from research to being listed.

In 2019, out of the 25 assets that Coinbase announced research on, 21 of them have received venture capital support.

Author: StevenZheng

PANews authorized translation and publication, original source link:

https://www.theblockcrypto.com/genesis/40733/analyzing-coinbases-asset-exploration-announcements

Coinbase's goal has always been to allow its users to "access...at least 90% of the total market cap of all circulating digital assets." A recent announcement from the exchange revealed that there are currently 17 new coins being researched, some of which have not yet launched their mainnet.

In this article, TheBlock will examine Coinbase's practice of researching assets and why most of the assets researched by Coinbase in 2019 are venture-backed.

On July 13, 2018, Coinbase announced for the first time that it would conduct research on assets before listing them. The San Francisco-based startup believed that this practice was "to remain open and transparent to our users and let them know what assets we have considered supporting for potential listing." So far, Coinbase has announced research on 58 assets, with 19 already listed at the time of writing.

On average, it takes about 75 days for an asset to go from research to being listed, with a median waiting time of around 57 days.

?

The graph below shows the waiting time for the 19 assets mentioned above. Stellar Lumens (XLM) took the longest, as it was announced by Coinbase as one of the first assets to be researched on July 13, 2018, but its trading pair support was only announced on March 13, 2019. The shortest waiting time was for Civic (CVC), District0x (DNT), Loom Network (LOOM), and Decentraland (MANA), as these assets were listed within a few hours after Coinbase announced the research.

?

Source: TheBlock

Coinbase's recent announcement of research for listings has received criticism. Critics argue that these assets are mainly projects backed by venture capital, using Coinbase as an exit channel to sell their coins to retail investors.

TheBlock studied Coinbase's research announcements for listings in 2019 to identify the venture capital firms/individuals benefiting the most from listings. In 2019, Coinbase announced research on a total of 25 assets.

Based on publicly available funding announcements and information about investors on project websites, TheBlock confirmed that out of the 25 assets, 21 of them have venture capital backing. The most active investors among these 21 projects are MetaStable Capital, Multicoin Capital, and Polychain Capital, who have invested in 8 of these projects collectively.

In addition, TheBlock also created a diagram illustrating the investment patterns of the 19 most active investors in these 21 projects. The most popular project among venture capitalists is Coda, with 11 out of 19 active investors supporting it. Handshake follows closely, receiving support from 10 out of the 19 investors.

Source: TheBlock

?

作者:Coinbase前CTO Balaji Srinivasan,来源:作者推特@balajis;编译:白水,金色财经 一夜之间,美国下一任总统的绝大部分净资产(590 亿美元)现在都以加密货币的形式持有。即使下跌 ...

gz呺Web3团子比特币的低波动性成功地吸引了散户和大型投资者,他们一直在利用这个机会购买加密货币随着收入的持续增长,矿工的销售压力降低来自Glassnode的最新数据表明,比特币 [BTC] 的波动性在上个月大幅下降。...

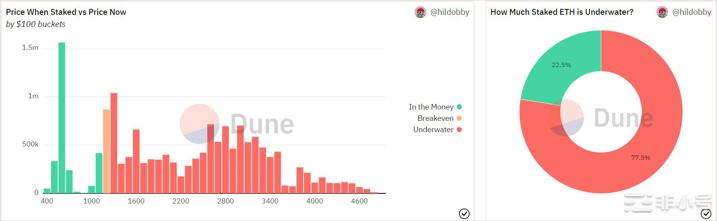

截至发稿时,超过 70% 的以太坊股份已被淹没上海升级将在部署后启用 unstaking质押以太坊 [ETH],特别是在合并之后,引发了几次对话。讨论的主题从占主导地位的权益池到符合 OFAC 的区块,以及两者的结合对以...

利用高性能计算和加密代币解锁未来Web3GPU计算领域正在迅速发展,以满足对高性能计算能力日益增长的需求。资源访问:开发人员使用代币来利用GPU能力。开发商和投资者的利益此类平台为开发者提供可扩展的基础设施,支持从深度学...