爱荷华州司法委员会批准了一项看似进步的数字资产法案,对《统一商法典》进行了重大修订,明确旨在将数字资产和电子记录纳入商业交易。该法案名为 House File 2519,标题为“与商业交易有关的法案,包括电子记录和数字资产的控制和传输”。

正如司法委员会 2 月 15 日通过 TrackBill 监测的报告所述,这项立法旨在解决商业法律框架内数字资产带来的复杂性和机遇。通过提供一种细致入微的电子记录控制和传输方法,该法案承诺提高数字交易的法律清晰度和安全性,满足不断发展的数字经济的需求。

House File 2519 通过为“可控电子记录”、“数字资产”和“智能合约”等术语提供全面的定义,澄清了数字资产的法律地位。这种精确性旨在减少歧义并为数字商务营造更安全的环境。然而,州、联邦和国际司法管辖区之间的此类定义可能存在差异,这增加了数字资产服务提供商的潜在复杂性。

将数字资产视为个人财产

然而,新的定义是该法案的一个关键方面。该法案承认2022年《统一商法典修正案》第12条中智能合约的合法性,规定不能仅仅因为合同是通过分布式账本技术或智能合约执行而否认其法律效力或可执行性。这确保了智能合约在满足某些条件时自动执行合同条款,与传统合同具有相同的法律地位。

此外,该法案还引用了 2022 年法案中促进通过电子方式记录房地产的规定。具体来说,它强调了如果转让证据符合州法律概述的一般要求,并且格式符合电子服务系统设定的标准,则该县记录房地产转让的能力。该法案规定,该系统使各县和爱荷华县记录员协会能够合作实施县土地记录信息系统。

Building on these aspects of the 2022 Act, House File 2519 aims to amend and add to the legal framework surrounding digital assets, focusing on adjusting the definition of “digital asset.” The bill amends the definition by eliminating exceptions previously recognized under the Uniform Commercial Code (UCC). This means that certain electronic records previously excluded from being considered digital assets, such as electronic records representing an interest in specific physical or tangible property (chattel) or a lease of such property, are no longer excluded.

For example, suppose a business takes out a loan to purchase a piece of equipment, and the loan agreement also grants the lender a security interest in that equipment as collateral. In that case, the document detailing this arrangement can be considered chattel paper. If this document is created, signed, and stored electronically, it’s an electronic record evidencing chattel paper. This digital form is increasingly common in today’s digital and financial transactions, offering a more secure and efficient way to electronically manage and transfer interests in real-world assets (RWA).

The amendment simplifies the classification of digital assets, treating them simply as personal property rather than specifically as intangible personal property. This is a shift from the possible previous categorization that might have considered digital assets more narrowly as intangible personal property. This broader classification could have implications for how digital assets are treated in various legal and commercial contexts, providing a more straightforward approach to their classification.

Intangible personal property historically referred to rights and licenses, whereas tokenized RWAs related to real estate may be more appropriately treated as personal property akin to physical property.

These provisions reflect House File 2519’s approach to further integrating digital assets into Iowa’s commercial and legal frameworks. By amending the definition of digital assets and clarifying their classification, the bill aims to simplify and modernize the regulatory environment for digital assets, making it more conducive to the evolving digital economy. Additionally, by defining terms such as “electronic services system,” the bill provides legal clarity for the operation of digital asset systems and services within the state.

Interestingly, the legislation outlines no-action protection for qualifying purchasers of controllable electronic records, asserting that filing a financing statement under Article 9 does not constitute notice of a property right claim in a controllable electronic record.

立法中的这一规定意味着购买可控电子记录(例如数字资产或代币)的个人将获得法律保护,免受仅因缺乏财务报表而对其所有权提出质疑的索赔。从本质上讲,即使没有提交融资声明来公开声明数字资产的担保权益,购买者对该资产的权利也受到保护。其目的是通过简化所有权证明并减轻参与数字交易的各方的管理负担来简化交易。

国家通过未经认可的中立立法与 CBDC 保持距离。

该法案还明确指出,其条款不应被解释为支持、认可、创建或实施国家数字货币。这一立场确保立法对于国家政府或中央银行集中发行的数字货币(CBDC)保持中立,而是将重点放在数字资产的监管框架上,而不促进或促进国家数字货币的建立。

House File 2519 对数字资产服务提供商和用户的潜在影响包括加强监管、增加法律和运营复杂性,以及需要进行技术调整以满足数字资产控制的法律标准。这些挑战凸显了该法案全面尝试使爱荷华州的法律框架适应数字时代,平衡创新与法律清晰度和消费者保护。

House File 2519 代表着将数字资产纳入该州法律环境的一步,旨在为数字交易提供更安全、更清晰的法律框架。虽然该法案的详细方法引入了具体的监管和运营挑战,但它也为加强支持数字经济的法律基础设施提供了机会。

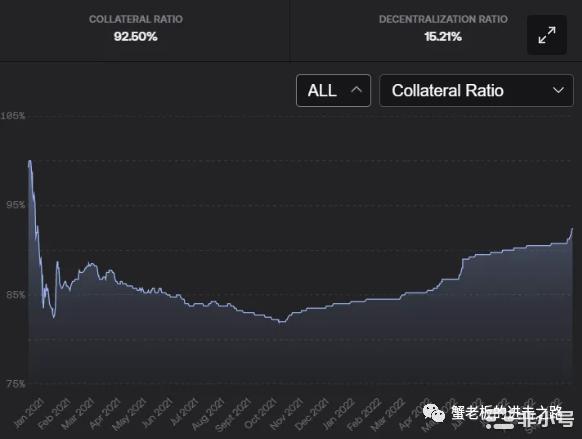

加密货币对进入众议院试图控制数字资产的监管法案并不陌生。今天,众议院发布了一项法案草案,重点是监管稳定币,特别是影响发行人和稳定币的抵押。总体而言,稳定币是第三大加密资产,几乎与以太坊一样大,市值为$52.8b 。该法案...

投资者继续关注美股财报、经济数据与央行官员讲话,并等待美联储将在周三公布的上次货币政策会议纪要。美股周二收高,加密市场联动效应再次凸显,比特币短线上攻,但上方抛压较重,后市预计短线回落,整体趋于窄幅震荡。一、大盘概述——...

美国参众两院立法委员DonBeyer明确提出“[数字货币市场的需求和投资者保护法令](1)”,他详细介绍道,“很多年来,数字货币持有人遭受了无所不在的诈骗、遭窃和销售市场操纵,而美国国会忽视了领域权威专家和联邦政府...

该法令草案即将获得批准,其中指定意大利央行和市场监管机构Consob为主管部门。此举符合欧盟的监管框架——加密资产市场(MiCA)。尽管只有2%的意大利家庭持有加密货币,但该国正在取得长足进步。还记得与Coinbase合...